Exhibit 99.1

OTCQB: INLX

Forward - Looking Statements This presentation contains certain forward - looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . Expressions of future goals and similar expressions reflecting something other than historical fact are intended to identify forward - looking statements, but are not the exclusive means of identifying such statements . These forward - looking statements involve a number of risks and uncertainties that could case actual results to differ materially from those currently anticipated . Factors that could cause or contribute to such differences include, but are not limited to market acceptance, competitive factors and financial market conditions . Intellinetics undertakes no obligations to revise or update any forward - looking statements in order to reflect events or circumstances that may arise after the date of this presentation .

x Company Profile x The Business Problems We Solve x Business and Technology Strategy x Scale of Market Opportunity x Critical Unmet Market Needs We Fulfill x Intel - Enabled Channel Program ▪ Value to Channel ▪ Multi - Channel Strategy ▪ Muratec x Revenue Comparisons x Summary Agenda 1

• Enterprise Content Management (ECM) provider for Small to Medium Businesses (SMB) • Intellectual Property (IP ) Portfolio: cloud - ready software and managed services • 1,200+ Customers across multiple verticals • Cloud and Premise Enabled solutions strategically packaged with Intel™ technology Company Profile 2

Proven High Performance Technology 3

What is ECM? Tools and Strategies for Unstructured Data 4

Intellinetics Business and Technology Strategy Fulfill the huge unmet ECM needs of SMB’s by enabling those from whom they already buy to introduce turnkey, compliant document solutions as a feature of the copiers and services they have or are in the market for . 5

Three - Point Strategy For Channel Distribution Office Equipment Dealers (OED) Size: 3,500 ECM Value Added Resellers Size: 500 SMB ERP Partner - Driven Direct Size: 1000 6

SMB ERP Partner - Driven Direct x Line of Business ERP Platforms Missing ECM x Proprietary Integration Out - of - the - Box x Low Cost Access to Captive Installation Base x Repeatable Business Value Proposition Validated By People They Trust x Targeting Compliance / Regulatory Ladened Markets 7

ECM Value Added Resellers (VAR) x Companies whose core business model is ECM driven: ▪ Expert Level ECM Knowledge ▪ Primary Revenue Sources » Software » Professional Services » Document Conversion x Vertical Focused x Displacement Scenario 8

Office Equipment Dealers (OED) Three Key Profiles: ▪ Copier Centric ▪ Copier + Solutions ▪ Solutions x Large network with deep roots in copier sales, financing and service x Experts in building trust / intimacy with SMB 9

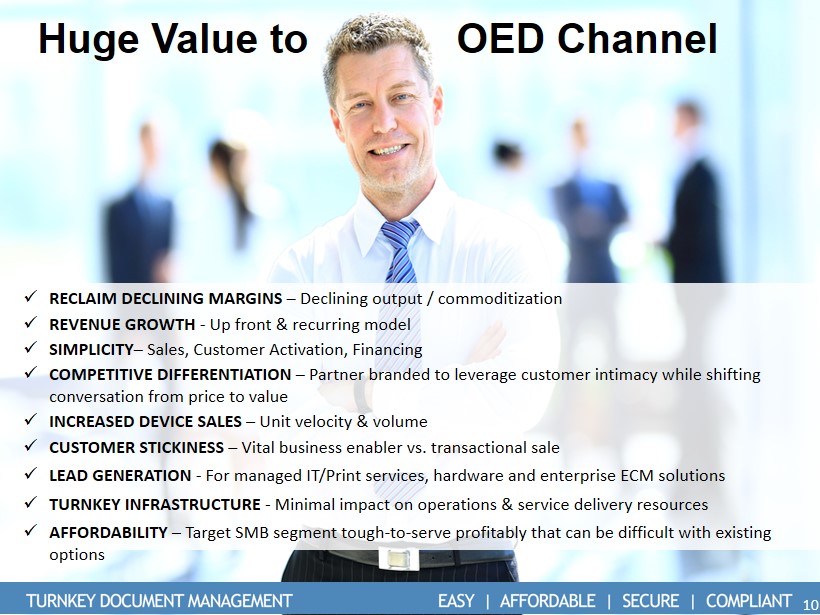

Huge Value to OED Channel x RECLAIM DECLINING MARGINS – Declining output / commoditization x REVENUE GROWTH - Up front & recurring model x SIMPLICITY – Sales, Customer Activation, Financing x COMPETITIVE DIFFERENTIATION – Partner branded to leverage customer intimacy while shifting conversation from price to value x INCREASED DEVICE SALES – Unit velocity & volume x CUSTOMER STICKINESS – Vital business enabler vs. transactional sale x LEAD GENERATION - For managed IT/Print services, hardware and enterprise ECM solutions x TURNKEY INFRASTRUCTURE - Minimal impact on operations & service delivery resources x AFFORDABILITY – Target SMB segment tough - to - serve profitably that can be difficult with existing options 10

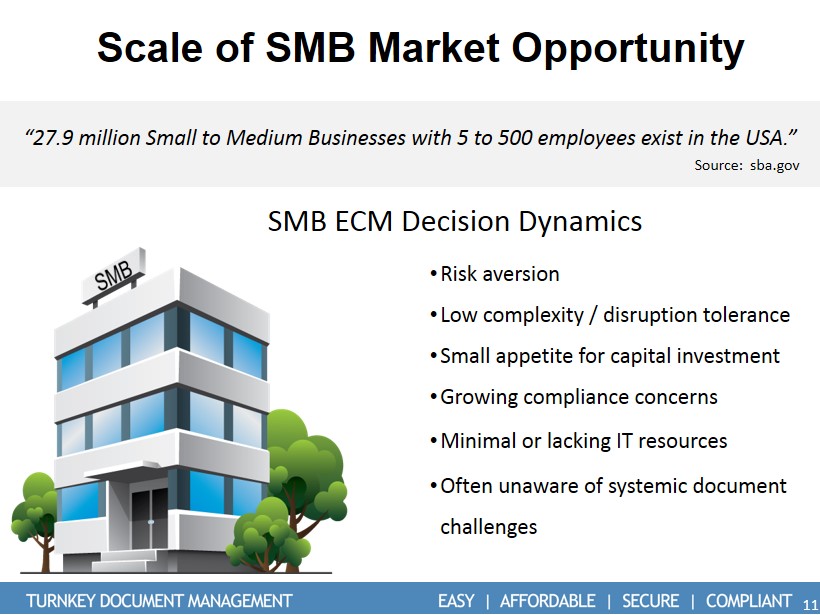

Scale of SMB Market Opportunity • Risk aversion • Low complexity / disruption tolerance • Small appetite for capital investment • Growing compliance concerns • Minimal or lacking IT resources • Often unaware of systemic document challenges “27.9 million Small to Medium Businesses with 5 to 500 employees exist in the USA.” Source: sba.gov SMB ECM Decision Dynamics 11

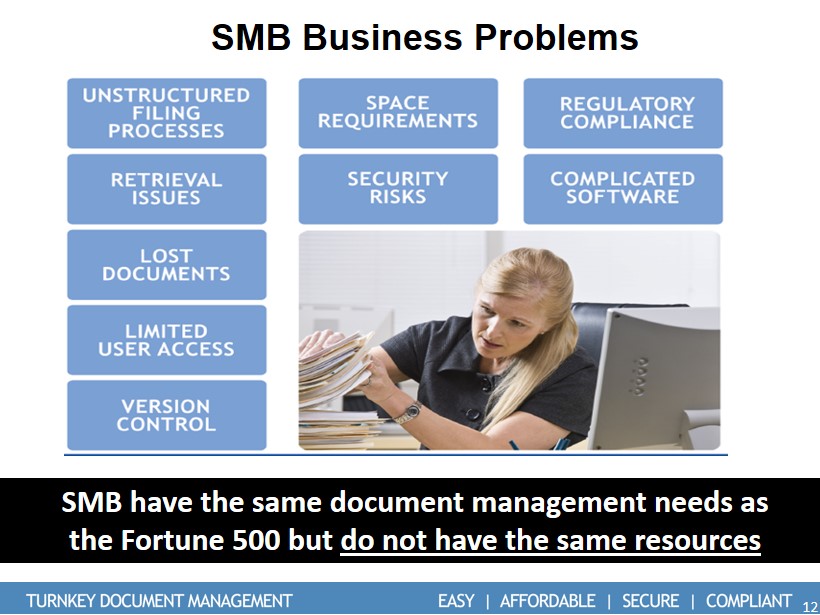

SMB Business Problems SMB have the same document management needs as the Fortune 500 but do not have the same resources 12

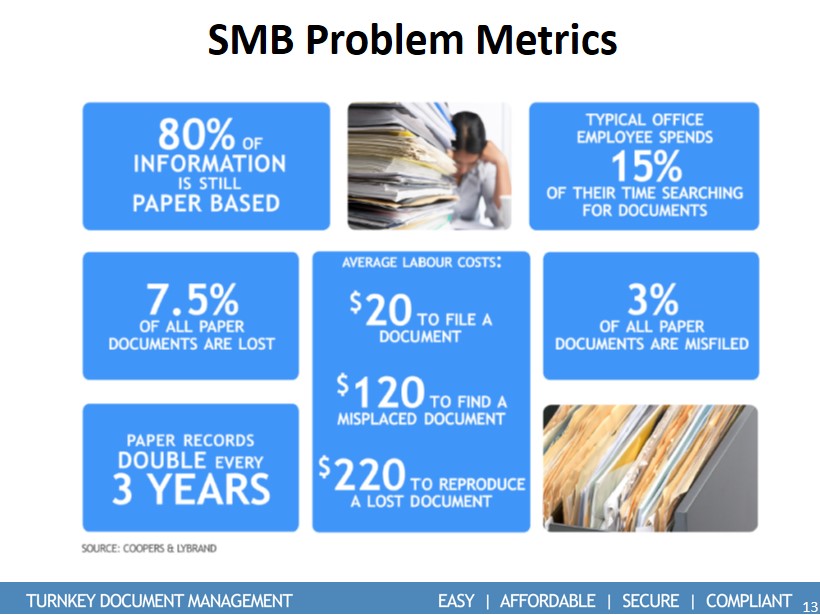

SMB Problem Metrics 13

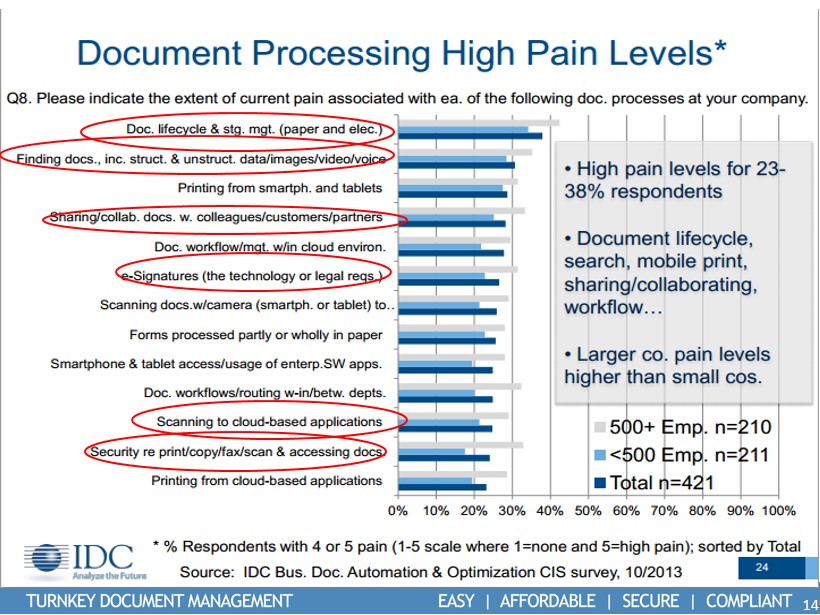

14

“Documents? Oh Yeah – We’re Good!” John Doe, HR Manager 15

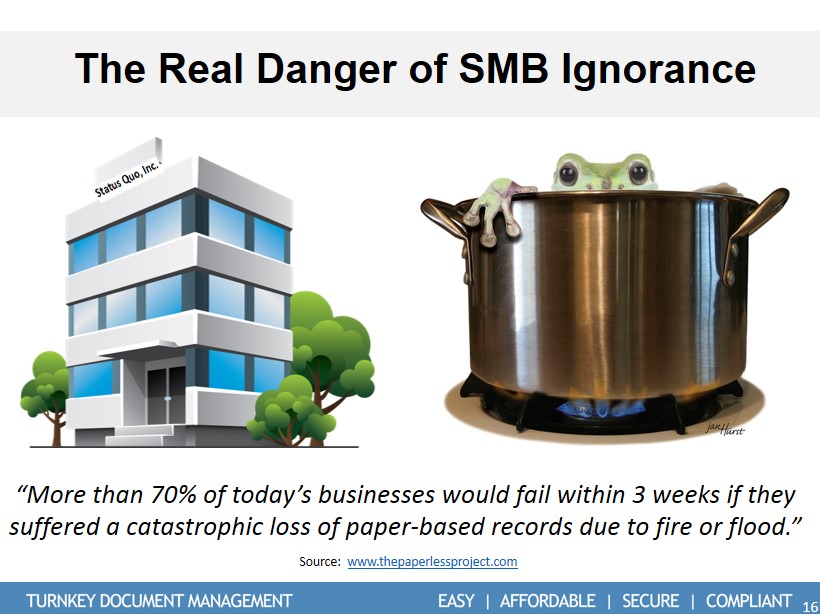

The Real Danger of SMB Ignorance “More than 70% of today’s businesses would fail within 3 weeks if they suffered a catastrophic loss of paper - based records due to fire or flood .” Source: www.thepaperlessproject.com 16

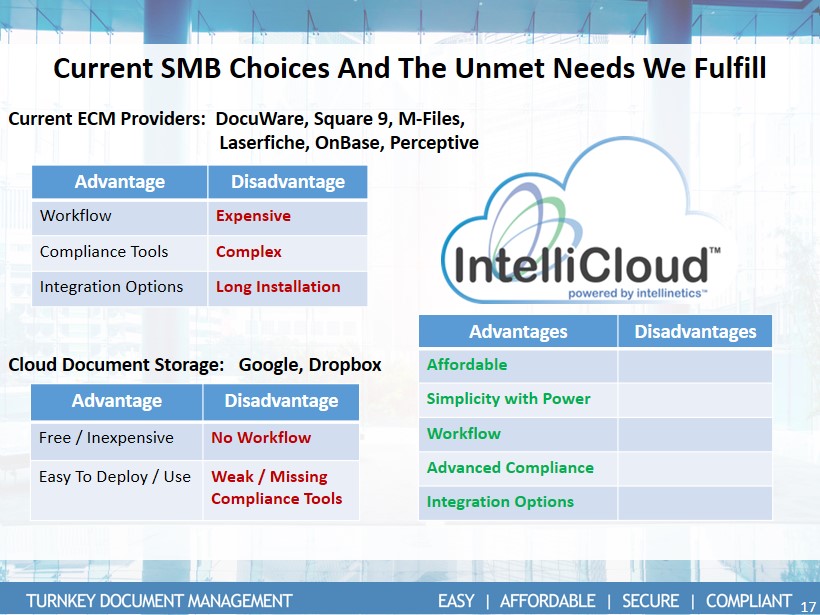

Current SMB Choices And The Unmet Needs We Fulfill Current ECM Providers: DocuWare, Square 9, M - Files, Laserfiche, OnBase, Perceptive Cloud Document Storage : Google, Dropbox 17 Advantage Disadvantage Workflow Expensive Compliance Tools Complex Integration Options Long Installation Advantage Disadvantage Free / Inexpensive No Workflow Easy To Deploy / Use Weak / Missing Compliance Tools Advantages Disadvantages Affordable Simplicity with Power Workflow Advanced Compliance Integration Options

Intel and IntelliCloud Powered By 18 www.intel.com/intellicloud

IntelliCloud™ is a real game - changer because it allows the office equipment reseller channel to shift what is often a price - driven, transactional sale into a value - driven process without the complexity associated with other offerings. “ ” Lou Stricklin, VP Marketing, Muratec Americas 19 Strategic Alliance – Channel Acceleration

Program - Enabled Lead Generation Sample Lead Generation Messaging In Channel 20

21 The IntelliCloud Office: Knowledge In Motion

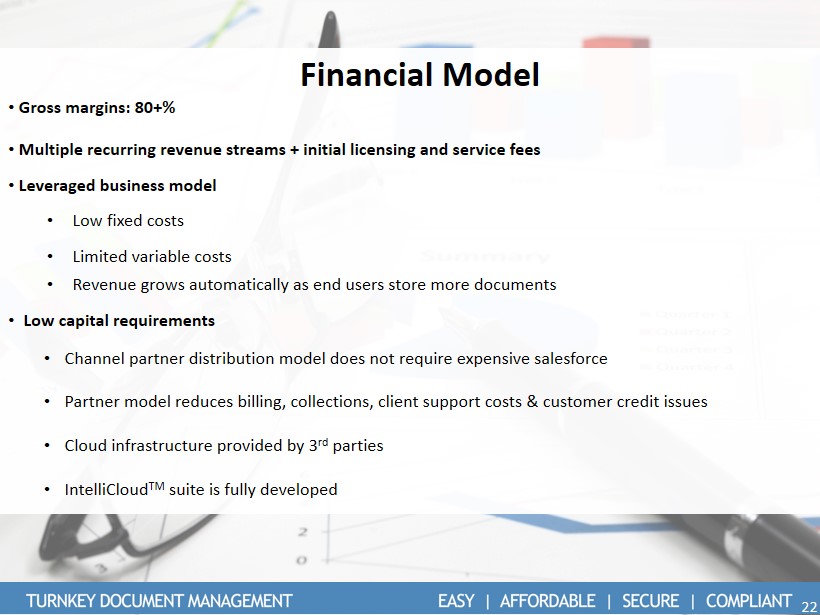

o Financial Model • Gross m argins: 80+% • Multiple r ecurring revenue streams + i nitial l icensing and service fees • Leveraged business model • Low fixed costs • Limited variable c osts • Revenue grows automatically as end users store more documents • Low capital r equirements • Channel p artner distribution model does not require expensive salesforce • Partner model reduces billing, collections, client support costs & customer credit issues • Cloud infrastructure provided by 3 rd parties • IntelliCloud TM suite is fully developed 22

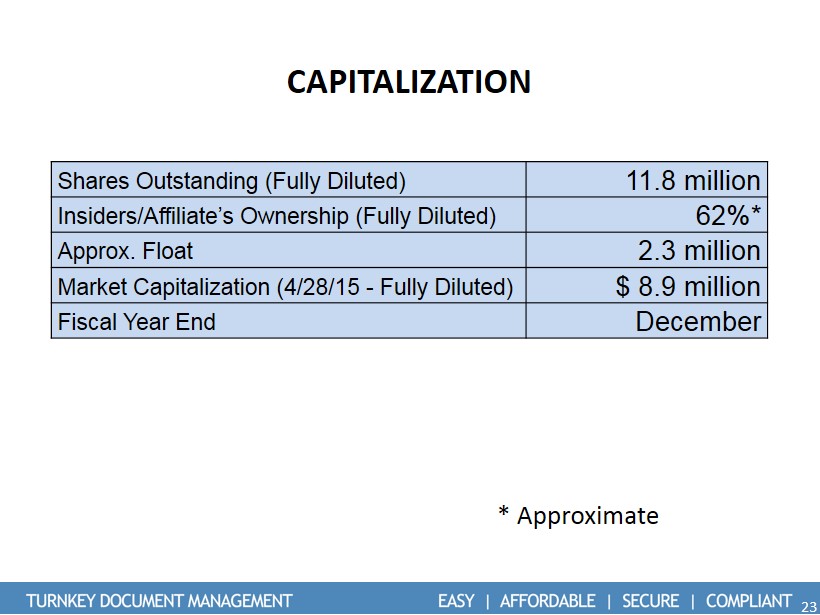

CAPITALIZATION Shares Outstanding (Fully Diluted) 11.8 million Insiders/Affiliate’s Ownership (Fully Diluted) 62 %* Approx. Float 2.3 million Market Capitalization (4/28/15 - Fully Diluted) $ 8.9 million Fiscal Year End December * Approximate 23

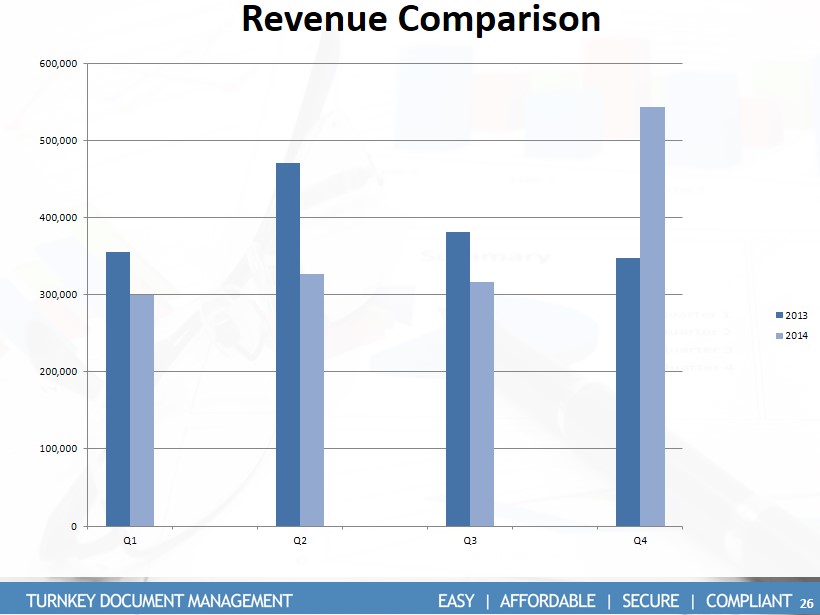

o Revenue Comparison 0 100,000 200,000 300,000 400,000 500,000 600,000 Q1 Q2 Q3 Q4 2013 2014 26

Summary x Realigned 3 - Point Strategy for Channel x Intel and Muratec Strategic Catalysts for Growth x Real Momentum Reflected in Key Performance Indicators • Revenue • Channel Expansion • Sales Funnel • Market Leader Adoption x Leadership Eco - System Expansion 26

Company Murray Gross, Chairman of the Board mgross@intellinetics.com 614.921.8170 INLX (OTCQB) Investor Relations Terri MacInnis, VP of IR Bibicoff + MacInnis terri@bibimac.com 818.379.8500