Exhibit 10.32

LEASE

SFERS Real Estate Corp. T,

a Delaware corporation

Landlord,

and

The Avatar Group Inc.,

a Ohio corporation

Tenant

TABLE OF CONTENTS

| Article | Page | |||||

| 1. | USE AND RESTRICTIONS ON USE | 1 | ||||

| 2. | TERM | 1 | ||||

| 3. | RENT | 2 | ||||

| 4. | RENT ADJUSTMENTS | 2 | ||||

| 5. | SECURITY DEPOSIT | 3 | ||||

| 6. | ALTERATIONS | 4 | ||||

| 7. | REPAIR | 5 | ||||

| 8. | LIENS | 5 | ||||

| 9. | ASSIGNMENT AND SUBLETTING | 5 | ||||

| 10. | INDEMNIFICATION | 7 | ||||

| 11. | INSURANCE | 7 | ||||

| 12. | WAIVER OF SUBROGATION | 7 | ||||

| 13. | SERVICES AND UTILITIES | 7 | ||||

| 14. | HOLDING OVER | 8 | ||||

| 15. | SUBORDINATION | 8 | ||||

| 16. | RULES AND REGULATIONS | 8 | ||||

| 17. | REENTRY BY LANDLORD | 8 | ||||

| 18. | DEFAULT | 8 | ||||

| 19. | REMEDIES | 9 | ||||

| 20. | TENANT’S BANKRUPTCY OR INSOLVENCY | 11 | ||||

| 21. | QUIET ENJOYMENT | 11 | ||||

| 22. | DAMAGE BY FIRE, ETC. | 12 | ||||

| 23. | EMINENT DOMAIN | 12 | ||||

| 24. | SALE BY LANDLORD | 13 | ||||

| 25. | ESTOPPEL CERTIFICATES | 13 | ||||

| 26. | SURRENDER OF PREMISES | 13 | ||||

| 27. | NOTICES | 13 | ||||

| 28. | TAXES PAYABLE BY TENANT | 14 | ||||

| 29. | INTENTIONALLY DELETED | 14 | ||||

| 30. | DEFINED TERMS AND HEADINGS | 14 | ||||

| 31. | TENANT’S AUTHORITY | 14 | ||||

| 32. | COMMISSIONS | 14 | ||||

| 33. | TIME AND APPLICABLE LAW | 14 | ||||

| 34. | SUCCESSORS AND ASSIGNS | 14 | ||||

| 35. | ENTIRE AGREEMENT | 14 | ||||

| 36. | EXAMINATION NOT OPTION | 14 | ||||

| 37. | RECORDATION | 15 | ||||

| 38. | LIMITATION OF LANDLORD’S LIABILITY | 16 | ||||

| EXHIBIT A-PREMISES | ||||||

| EXHIBIT B-INITIAL ALTERATIONS | ||||||

| EXHIBIT C-RULES AND REGULATIONS | ||||||

| RIDER TO LEASE | ||||||

MULTI-TENANT INDUSTRIAL NET LEASE

REFERENCE PAGE

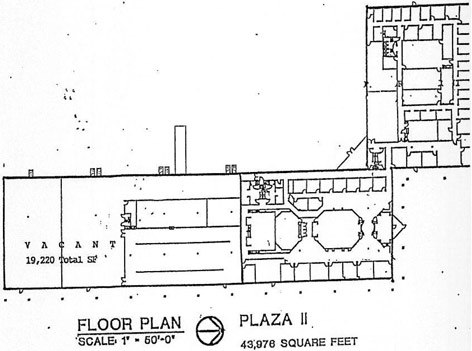

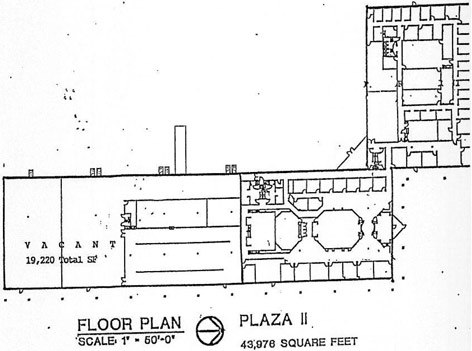

| BUILDING: |

Plaza II 2170-2200 Dividend Drive Columbus, Ohio 43228 | |

| LANDLORD: |

SFERS Real Estate Corp. T, a Delaware Corporation | |

| LANDLORD’S ADDRESS: |

2218 Dividend Drive Columbus, Ohio 43228 | |

| LEASE REFERENCE DATE: |

June 21,1999 | |

| TENANT: |

The Avatar Group Inc., an Ohio corporation | |

| TENANT’S ADDRESS: |

||

| (a) As of beginning of Term :

(b) Prior to beginning of Term (if different): |

(a) 2190 Dividend Drive Columbus, Ohio (b) 434 E. Rich Street Columbus, Ohio 43215 | |

| PREMISES IDENTIFICATION: |

Suite Number 2190 (for outline of Premises see Exhibit A) | |

| PREMISES RENTABLE AREA: |

approximately 12,302 sq. ft. | |

| USE: |

general office and warehouse | |

| SCHEDULED COMMENCEMENT DATE: |

June 22, 1999 | |

| TERMINATION DATE: |

November 30, 2004 | |

| TERM OF LEASE: |

5 years, five (5) months and nine (9) days beginning on the Commencement Date and ending on the Termination Date (unless sooner terminated pursuant to the lease) | |

| INITIAL ANNUAL RENT (Article 3): |

$ See Rent Schedule in Article 3 | |

| INITIAL MONTHLY INSTALLMENT OF ANNUAL RENT (Article3): |

$ See Rent Schedule in Article 3 | |

| INITIAL ESTIMATED MONTHLY INSTALLMENT OF RENT ADJUSTMENTS (Article 4): |

$2,050.33 ($2.00 psf/yr) | |

| TENANT’S PROPORTIONATE SHARE: |

27.97% (12,302 sf/43,976 sf) | |

| SECURITY DEPOSIT: |

$7,000.00 | |

| ASSIGNMENT/SUBLETTING FEE |

$1,000.00 | |

| REAL ESTATE BROKER DUE COMMISSION: |

Rj Boll Realty | |

The Reference Page information is incorporated into and made a part of the Lease. In the event of any conflict between any Reference Page information and the Lease, the Lease shall control. This Lease includes Exhibits A through C and Rider, all of which are made a part of this Lease.

| LANDLORD: | TENANT: | |||||||

| SFERS Real Estate Corp. T, a Delaware corporation |

The Avatar Group Inc., an Ohio corporation | |||||||

| By: RREEF Management Company, a Delaware corporation |

||||||||

| By: |

/s/ Philip Schneider | By: | /s/ A. Michael Chretien | |||||

| Title: | Philip Schneider District Manager |

Title: |

A. Michael Chretien President | |||||

| Dated: June 21, 1999 | Dated: 6/21/1999 | |||||||

LEASE

By this Lease Landlord leases to Tenant and Tenant leases from Landlord the Premises in the Building as set forth and described on the Reference Page. The Reference Page, including all terms defined thereon, is incorporated as part of this Lease.

1. USE AND RESTRICTIONS ON USE.

1.1 The Premises are to be used solely for the purposes stated on the Reference Page. Tenant shall not do or permit anything to be done in or about the Premises which will in any way obstruct or interfere with the rights of other tenants or occupants of the Building or injure, annoy, or disturb them or allow the Premises to be used for any improper, immoral, unlawful, or objectionable purpose. Tenant shall not do, permit or suffer in, on, or about the Premises the sale of any alcoholic liquor without the written consent of Landlord first obtained, or the commission of any waste. Tenant shall comply with all governmental laws, ordinances and regulations applicable to the use of the Premises and its occupancy and shall promptly comply with all governmental orders and directions for the correction, prevention and abatement of any violations in or upon, or in connection with, the Premises, all at Tenant’s sole expense. Tenant shall not do or permit anything to be done on or about the Premises or bring or keep anything into the Premises which will in any way increase the rate of, invalidate or prevent the procuring of any insurance protecting against loss or damage to the Building or any of its contents by fire or other casualty or against liability for damage to property or injury to persons in or about the Building or any part thereof.

1.2 Tenant shall not, and shall not direct, suffer or permit any of its agents, contractors, employees, licensees or invitees to at any time handle, use, manufacture, store or dispose of in or about the Premises or the Building any (collectively “Hazardous Materials”) flammables, explosives, radioactive materials, hazardous wastes or materials, toxic wastes or materials, or other similar substances, petroleum products or derivatives or any substance subject to regulation by or under any federal, state and local laws and ordinances relating to the protection of the environment or the keeping, use or disposition of environmentally hazardous materials, substances, or wastes, presently in effect or hereafter adopted, all amendments to any of them, and all rules and regulations issued pursuant to any of such laws or ordinances (collectively “Environmental Laws”), nor shall Tenant suffer or permit any Hazardous Materials to be used in any manner not fully in compliance with all Environmental Laws, in the Premises or the Building and appurtenant land or allow the environment to become contaminated with any Hazardous Materials. Notwithstanding the foregoing, and subject to Landlord’s prior consent, Tenant may handle, store, use or dispose of products containing small quantities of Hazardous Materials (such as aerosol cans containing insecticides, toner for copiers, paints, paint remover and the like) to the extent customary and necessary for the use of the Premises for general office purposes; provided that Tenant shall always handle, store, use, and dispose of any such Hazardous Materials in a safe and lawful manner and never allow such Hazardous Materials to contaminate the Premises, Building and appurtenant land or the environment. Tenant shall protect, defend, indemnify and hold each and all of the Landlord Entities (as defined in Article 30) harmless from and against any and all loss, claims, liability or costs (including court costs and attorney’s fees) incurred by reason of any actual or asserted failure of Tenant to fully comply with all applicable Environmental Laws, or the presence, handling, use or disposition in or from the Premises of any Hazardous Materials (even though permissible under all applicable Environmental Laws or the provisions of this Lease), or by reason of any actual or asserted failure of Tenant to keep, observe, or perform any provision of this Section 1.2.

2. TERM.

2.1 The Term of this Lease shall begin on the date (“Commencement Date”) which shall be the later of the Scheduled Commencement Date as shown on the Reference Page and the date that Landlord shall tender possession of the Premises to Tenant. Landlord shall tender possession of the Premises with all the work, if any, to be performed by Landlord pursuant to Exhibit B to this Lease substantially completed. Tenant shall deliver a punch list of items not completed within 30 days after Landlord tenders possession of the Premises and Landlord agrees to proceed with due diligence to perform its obligations regarding such items. Landlord and Tenant shall execute a memorandum setting forth the actual Commencement Date and Termination Date.

2.2 Tenant agrees that in the event of the inability of Landlord to deliver possession of the Premises on the Scheduled Commencement Date, Landlord shall not be liable for any damage resulting from such inability, but Tenant shall not be liable for any rent until the time when Landlord can, after notice to Tenant, deliver possession of the Premises to Tenant. No such failure to give possession on the Scheduled Commencement Date shall affect the other obligations of Tenant under this Lease, except that if Landlord is unable to deliver possession of the Premises within one hundred twenty (120) days of the Scheduled Commencement Date (other than as a result of strikes, shortages of materials or similar matters beyond the reasonable control of Landlord and Tenant is notified by Landlord in writing as to such delay), Tenant shall have the option to terminate this Lease unless said delay is as a result of: (a) Tenant’s failure to agree to plans and specifications; (b) Tenant’s request for materials, finishes [ILLEGIBLE] installations other than Landlord’s standard except those, if any, that Landlord shall have expressly agreed to furnish without extension of time agreed by Landlord; (c) Tenant’s change in any plans or specifications; or, (d) performance or completion by a party employed by Tenant. If any delay is the result of any of the foregoing, the Commencement Date and the payment of rent under this Lease shall be accelerated by the number of days of such delay.

3

2.3 In the event Landlord shall permit Tenant to occupy the Premises prior to the Commencement Date, such occupancy shall be subject to all the provisions of this Lease. Said early possession shall not advance the Termination Date.

3. RENT.

3.1 Tenant agrees to pay to Landlord the Annual Rent in effect from time to time by paying the Monthly Installment of Rent then in effect on or before the first day of each full calendar month during the Term, except that the first month’s rent shall be paid upon the execution of this Lease. The Monthly Installment of Rent in effect at any time shall be one-twelfth of the Annual Rent in effect at such time. Rent for any period during the Term which is less than a full month shall be a prorated portion of the Monthly Installment of Rent based upon a thirty (30) day month. Said rent shall be paid to Landlord, without deduction or offset and without notice or demand, at the Landlord’s address, as set forth on the Reference Page, or to such other person or at such other place as Landlord may from time to time designate in writing.

Rent Schedule.

| Period |

Annual Rent (psf/yr.) | Monthly Installment | Monthly Amortization (psf/yr.) |

Total Base Rent | ||||

| 6/22/1999-08/31/1999 |

Free Rent & Operating Expenses | |||||||

| 09/1/1999-08/31/2000 |

$57,696.38 ($4.69) | $4,808.03 | $584.35 ($.57) | $5,392.38 | ||||

| 09/1/2000-08/31/2001 |

$76,887.50 ($6.25) | $6,407.29 | $584.35 ($.57) | $6,991.64 | ||||

| 09/1/2001-08/31/2002 |

$79,963.00 ($6.50) | $6,663.58 | $584.35 ($.57) | $7,247.93 | ||||

| 09/1/2002-11/30/2004 |

$83.038.50 ($6.75) | $6,919.88 | $584.35 ($.57) | $7,504.23 |

3.2 Tenant recognizes that late payment of any rent or other sum due under this Lease will result in administrative expense to Landlord, the extent of which additional expense is extremely difficult and economically impractical to ascertain. Tenant therefore agrees that if rent or any other sum is not paid when due and payable pursuant to this Lease, a late charge shall be imposed in an amount equal to the greater of: (a) Fifty Dollars ($50.00), or (b) a sum equal to five percent (5%) per month of the unpaid rent or other payment. The amount of the late charge to be paid by Tenant shall be reassessed and added to Tenant’s obligation for each successive monthly period until paid. The provisions of this Section 3.2 in no way relieve Tenant of the obligation to pay rent or other payments on or before the date on which they are due, nor do the terms of this Section 3.2 in any way affect Landlord’s remedies pursuant to Article 19 in the event said rent or other payment is unpaid after date due.

4. RENT ADJUSTMENTS.

4.1 For the purpose of this Article 4, the following terms are defined as follows:

4.1.1 Lease Year: Each calendar year falling partly or wholly within the Term.

4.1.2 Direct Expenses: All direct costs of operation, maintenance, repair and management of the Building (including the amount of any credits which Landlord may grant to particular tenants of the Building in lieu of providing any standard services or paying any standard costs described in this Section 4.1.2 for similar tenants), as determined in accordance with generally accepted accounting principles, including the following costs by way of illustration, but not limitation: water and sewer charges; insurance charges of or relating to all insurance policies and endorsements deemed by Landlord to be reasonably necessary or desirable and relating in any manner to the protection, preservation, or operation of the Building or any part thereof; utility costs, including, but not limited to, the cost of heat, light, power, steam, gas, and waste disposal; the cost of security and alarm services (including any central station signaling system); window cleaning costs; labor costs; costs and expenses of managing the Building including management fees; air conditioning maintenance costs; material costs; equipment costs including the cost of maintenance, repair and service agreements and rental and leasing costs; purchase costs of equipment other than capital items; current rental and leasing costs of items which would be amortizable capital items if purchased; tool costs; licenses, permits and inspection fees; wages and salaries; employee benefits and payroll taxes; accounting and legal fees; any sales, use or service taxes incurred in connection therewith. Direct Expenses shall not include depreciation or amortization of the Building or equipment in the Building except as provided herein, loan principal payments, costs of alterations of tenants’ premises, leasing commissions, interest expenses on long-term borrowings, advertising costs or management salaries for executive personnel other than personnel located at the Building. In addition, Landlord shall be entitled to amortize and include as an additional rental adjustment: (i) an allocable portion of the cost of capital improvement items which are reasonably calculated to reduce operating expenses; (ii) fire sprinklers and suppression systems and other life safety systems; and (iii) other capital expenses which are required under any governmental laws, regulations or ordinances which were not

4

applicable to the Building at the time it was constructed. All such costs shall be amortized over the reasonable life of such improvements in. accordance with such reasonable life and amortization schedules as shall be determined by Landlord in accordance with generally accepted accounting principles, with interest on the unamortized amount at one percent (1%) in excess of the prime lending rate announced from time to time as such by The Northern Trust Company of Chicago, Illinois.

4.1.3 Taxes: Real estate taxes and any other taxes, charges and assessments which arc levied with respect to the Building or the land appurtenant to the Building, or with respect to any improvements, fixtures and equipment or other property of Landlord, real or personal, located in the Building and used in connection with the operation of the Building and said land, any payments to any ground lessor in reimbursement of tax payments made by such lessor; and all fees, expenses and costs incurred by Landlord in investigating, protesting, contesting or in any way seeking to reduce or avoid increase in any assessments, levies or the lax rate pertaining to any Taxes to be paid by Landlord in any Lease Year. Taxes shall not include any corporate franchise, or estate, inheritance or net income tax, or tax imposed upon any transfer by Landlord of its interest in this Lease or the Building.

4.2 Tenant shall pay as additional rent for each Lease Year Tenant’s Proportionate Share of Direct Expenses and Taxes incurred for such Lease Year.

4.3 The annual determination of Direct Expenses shall be made by Landlord and, if certified by a nationally recognized firm of public accountants selected by Landlord, shall be binding upon Landlord and Tenant. Tenant may review the books and records supporting such determination in the office of Landlord, or Landlord’s agent, during normal business hours, upon giving Landlord five (5) days advance written notice within sixty (60) days after receipt of such determination, but in no event more often than once in any one year period. In the event that during all or any portion of any Lease Year, the Building is not fully rented and occupied Landlord may make any appropriate adjustment in occupancy-related Direct Expenses for such year for the purpose of avoiding distortion of the amount of such Direct Expenses to be attributed to Tenant by reason of variation in total occupancy of the Building, by employing sound accounting and management principles to determine Direct Expenses that would have been paid or incurred by Landlord had the Building been fully rented and occupied, and the amount so determined shall be deemed to have been Direct Expenses for such Lease Year.

4.4 Prior to the actual determination thereof for a Lease Year, Landlord may from time to lime estimate Tenant’s liability for Direct Expenses and/or Taxes under Section 4.2, Article 6 and Article 28 for the Lease Year or portion thereof. Landlord will give Tenant written notification of the amount of such estimate and Tenant agrees that it will pay, by increase of its Monthly Installments of Rent due in such Lease Year, additional rent in the amount of such estimate. Any such increased rate of Monthly Installments of Rent pursuant to this Section 4.4 shall remain in effect until further written notification to Tenant pursuant hereto.

4.5 When the above mentioned actual determination of Tenant’s liability for Direct Expenses and/or Taxes is made for any Lease Year and when Tenant is so notified in writing, then:

4.5.1 If the total additional rent Tenant actually paid pursuant to Section 4.3 on account of Direct Expenses and/or Taxes for the Lease Year is less than Tenant’s liability for Direct Expenses and/or Taxes, then Tenant shall pay such deficiency to Landlord as additional rent in one lump sum within thirty (30) days of receipt of Landlord’s bill therefor; and

4.5.2 If the total additional rent Tenant actually paid pursuant to Section 4.3 on account of Direct Expenses and/or Taxes for the Lease Year is more than Tenant’s liability for Direct Expenses and/or Taxes, then Landlord shall credit the difference against the then next due payments to be made by Tenant under this Article 4.

4.6 If the Commencement Date is other than January 1 or if the Termination Date is other than December 31, Tenant’s liability for Direct Expenses and Taxes for the Lease Year in which said Date occurs shall be prorated based upon a three hundred sixty-five (365) day year.

4.7 Notwithstanding the language in Article 4.-Rcnt Adjustments, in no event shall Direct Expenses (excluding real estate taxes, insurance, and snow removal) for any calendar year exceed the product of .05 multiplied by the number of lease year elapsed, times $.77 psf/yr., plus $.77 psf/yr. ($.77 is the budget number for 1999 Direct Expenses, excluding real estate taxes, insurance and snow removal).

5. SECURITY DEPOSIT.

5.1 Tenant shall deposit the Security Deposit with Landlord upon the execution of this Lease. Said sum shall be held by Landlord as security for the faithful performance by Tenant of all the terms, covenants and conditions of this Lease to be kept and performed by Tenant and not as an advance rental deposit or as a measure of Landlord’s damage in case of Tenant’s default. If Tenant defaults with respect to any provision of this Lease, Landlord may use any part of the Security Deposit for the payment of any rent or any other sum in default, or at the payment of any amount which Landlord may spend or become obligated to spend by reason of Tenant’s default

5

or to compensate Landlord for any other loss or damage which Landlord may suffer by reason of Tenant’s default. If any portion is so used. Tenant shall within five (5) days after written demand therefor, deposit with Landlord an amount sufficient to restore the Security Deposit to its original amount and Tenant’s failure to do so shall be a material breach of this Lease. Except to such extent, if any, as shall be required by law, Landlord shall not be required to keep the Security Deposit separate from its general funds, and Tenant shall not be entitled to interest on such deposit. If Tenant shall fully and faithfully perform every provision of this Lease to be performed by it, the Security Deposit or any balance thereof shall be returned to Tenant within forty-five (45) days after termination of this Lease.

5.2 In addition to the Security Deposit and to further secure Tenant’s performance under the Lease, Tenant shall deposit with Landlord upon execution of this Lease the sum of $53,000 (as such sum may be adjusted from time to lime, the “Additional Deposit”) which, except as set forth herein, shall be subject to all the terms and conditions set forth in Section 5.1. Landlord shall hold the Additional Deposit in an interest-bearing account and the interest earned thereon shall be considered part of the Additional Deposit, provided that Landlord shall receive one-half of one percent (0.5%) of the Additional Deposit annually to offset Landlord’s administrative costs. Tenant shall also pledge to Landlord receivables with a fair value of at least $90,000, subject to no other liens or encumbrances (the “Receivables Pledge”), on a form reasonably acceptable to Landlord. No later than February 29, 2000, Tenant shall increase the Additional Deposit to $143,000 and Landlord shall thereupon release the Receivables Pledge, So long as there is then (at the time of payment) no uncured Event of Default or default which with the passage of time, the giving of notice or both, would become an Event of Default, and so long as there has never been a monetary Event of Default prior to such time, Landlord shall return (i) $50,000 of the Additional Deposit to Tenant on August 31, 2001, (ii) $50,000 of the Additional Deposit to Tenant on August 31, 2002, and (iii) the remainder of the Additional Deposit on August 31, 2003.

6. ALTERATIONS.

6.1 Except for those, if any, specifically provided for in Exhibit B to this Lease, Tenant shall not make or suffer to be made any alterations, additions, or improvements, including, but not limited to, the attachment of any fixtures or equipment in, on, or to the Premises or any part thereof or the making of any improvements as required by Article 7, without the prior written consent of Landlord. When applying for such consent, Tenant shall, if requested by Landlord, furnish complete plans and specifications for such alterations, additions and improvements. At Tenant’s specific request, at the lime Landlord consents it shall also advise Tenant as to whether or not Landlord will require removal of such alteration, additions and improvements at the end of the Term pursuant to paragraph 6.4.

6.2 In the event Landlord consents to the making of any such alteration, addition or improvement by Tenant, the same shall be made using Landlord’s contractor (unless Landlord agrees otherwise) at Tenant’s sole cost and expense. If Tenant shall employ any Contractor other than Landlord’s Contractor and such other Contractor or any Subcontractor of such other Contractor shall employ any non-union labor or supplier, Tenant shall be responsible for any and all delays, damages and extra costs suffered by Landlord as a result of any dispute with any labor unions concerning the wage, hours, terms or conditions of the employment of any such labor. In any event Landlord may charge Tenant a reasonable charge to cover its overhead as it relates to such proposed work.

6.3 All alterations, additions or improvements proposed by Tenant shall be constructed in accordance with all government laws, ordinances, rules and regulations and Tenant shall, prior to construction, provide the additional insurance required under Article 11 in such case, and also all such assurances to Landlord, including but not limited to, waivers of lien, surety company performance bonds and personal guaranties of individuals of substance as Landlord shall require to assure payment of the costs thereof and to protect Landlord and the Building and appurtenant land against any loss from any mechanic’s, materialmen’s or other liens. Tenant shall pay in addition to any sums due pursuant to Article 4, any increase in real estate taxes attributable to any such alteration, addition or improvement for so long, during the Term, as such increase is ascertainable; at Landlord’s election said sums shall be paid in the same way as sums due under Article 4.

| 6.4 | All alterations, additions, and improvements in, on, or to the Premises made or installed by Tenant, including carpeting, shall be and remain the property of Tenant during the Term but, excepting furniture, furnishings, movable partitions of less than full height from floor to ceiling and other trade fixtures, shall become a part of the really and belong to Landlord without compensation to Tenant upon the expiration or sooner termination of the Term, at which time title shall pass to Landlord under this Lease as by a bill of sale, unless Landlord elects otherwise. Upon such election by Landlord, Tenant shall upon demand by Landlord, at Tenant’s sole cost and expense, forthwith and with all due diligence remove any such alterations, additions or improvements which are designated by Landlord to be removed, and Tenant shall forthwith and with all due diligence, at its sole cost and expense, repair and restore the Premises to their original condition, reasonable wear and tear and damage by fire or other casualty excepted; provided, however, that, except to the extent otherwise specified by Landlord in writing prior to the commencement of construction, Tenant shall not be obligated to remove any of the improvements constructed pursuant to Exhibit B. |

6

7. REPAIR.

7.1 Landlord shall have no obligation to alter, remodel, improve, repair, decorate or paint the Premises, except as specified in Exhibit B if attached to this Lease and except that Landlord shall repair and maintain the structural portions of the roof, walls and foundation of the Building. In addition, during the first year of the Term, Landlord shall repair and maintain the heating and air conditioning units serving the Premises. By talking possession of the Premises, Tenant accepts them as being in good order, condition and repair and in the condition in which Landlord is obligated to deliver them. It is hereby understood and agreed that no representations respecting the condition of the Premises or the Building have been made by Landlord to Tenant, except as specifically set forth in this Lease. Landlord shall not be liable for any failure to make any repairs or to perform any maintenance unless such failure shall persist for an unreasonable time after written notice of the need of such repairs or maintenance is given to Landlord by Tenant.

7.2 Tenant shall at its own cost and expense keep and maintain all parts of the Premises and such portion of the Building and improvements as are within the exclusive control of Tenant in good condition, promptly making all necessary repairs and replacements, whether ordinary or extraordinary, with materials and workmanship of the same character, kind and quality as the original (including, but not limited to, repair and replacement of all fixtures installed by Tenant, water heaters serving the Premises, windows, glass and plate glass, doors, exterior stairs, skylights, any special office entries, interior walls and finish work, floors and floor coverings, heating and air conditioning systems serving the Premises, electrical systems and fixtures, sprinkler systems, dock boards, truck doors, dock bumpers, plumbing work and fixtures, and performance of regular removal of trash and debris). Tenant as part of its obligations hereunder shall keep the Premises in a clean and sanitary condition. Tenant will, as far as possible keep all such parts of the Premises from deterioration due to ordinary wear and from falling temporarily out of repair, and upon termination of this Lease in any way Tenant will yield up the Premises to Landlord in good condition and repair, loss by fire or other casualty excepted (but not excepting any damage to glass). Tenant shall, at its own cost and expense, repair any damage to the Premises or the Building resulting from and/or caused in whole or in part by the negligence or misconduct of Tenant, its agents, employees, invitees, or any other person entering upon the Premises as a result of Tenant’s business activities or caused by Tenant’s default hereunder. In the event that Tenant replaces the HVAC units during the Term, Landlord shall, upon termination of the Lease (unless such termination is due to Tenant’s default), pay Tenant the unamortized cost of such units, based upon the remaining useful life as of the termination.

7.3 Except as provided in Article 22, there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements in or to any portion of the Building or the Premises or to fixtures, appurtenances and equipment in the Building. Except to the extent, if any, prohibited by law, Tenant waives the right to make repairs at Landlord’s expense under any law, statute or ordinance now or hereafter in effect.

7.4 Tenant shall, at its own cost and expense, enter into a regularly scheduled preventive maintenance/service contract with a licensed maintenance contractor for servicing all heating and air conditioning systems and equipment serving the Premises (and a copy thereof shall be furnished to Landlord). The service contract must include all services suggested by the equipment manufacturer in the operation/maintenance manual and must become effective within thirty (30) days of the date Tenant takes possession of the Premises. Landlord may, upon notice to Tenant, enter into such a maintenance/ service contract on behalf of Tenant or perform the work and in either case, charge Tenant the cost thereof along with a reasonable amount for Landlord’s overhead.

8. LIENS. Tenant shall keep the Premises, the Building and appurtenant land and Tenant’s leasehold interest in the Premises free from any liens arising out of any services, work or materials performed, furnished, or contracted for by Tenant, or obligations incurred by Tenant. In the event that Tenant shall not, within ten (10) days following the imposition of any such lien, either cause the same to be released of record or provide Landlord with insurance against the same issued by a major title insurance company or such other protection against the same as Landlord shall accept, Landlord shall have the right to cause the same to be released by such means as it shall deem proper, including payment of the claim giving rise to such lien. All such sums paid by Landlord and all expenses incurred by it in connection therewith shall be considered additional rent and shall be payable to it by Tenant on demand.

9. ASSIGNMENT AND SUBLETTING.

9.1 Tenant shall not have the right to assign or pledge this Lease or to sublet the whole or any part of the Premises whether voluntarily or by operation of law, or permit the use or occupancy of the Premises by anyone other than Tenant, and shall not make, suffer or permit such assignment, subleasing or occupancy, without the prior written consent of Landlord, which shall not be unreasonably withheld, and said restrictions shall be binding upon any and all assignees of the Lease and subtenants of the Premises. In the event Tenant desires to sublet, or permit such occupancy of, the Premises, or any portion thereof, or assign this Lease, Tenant shall give written notice thereof to Landlord at least ninety (90) days but no more than one hundred eighty (180) days prior to the proposed

7

commencement date of such subletting or assignment, which notice shall set forth the name of the proposed subtenant or assignee, the relevant terms of any sublease or assignment and copies of financial reports and other relevant financial reports and other relevant financial information of the proposed subtenant or assignee.

9.2 Notwithstanding any assignment or subletting, permitted or otherwise, Tenant shall at all times remain directly, primarily and fully responsible and liable for the payment of the rent specified in this Lease and for compliance with all of its other obligations under the terms, provisions and covenants of this Lease. Upon the occurrence of an Event of Default, if the Premises or any part of them are then assigned or sublet, Landlord, in addition to any other remedies provided in this Lease or provided by law, may, at its option, collect directly from such assignee or subtenant all rents due and becoming due to Tenant under such assignment or sublease and apply such rent against any sums due to Landlord from Tenant under this Lease, and no such collection shall be construed to constitute a novation or release of Tenant from the further performance of Tenant’s obligations under this Lease.

9.3 In addition to Landlord’s right to approve of any subtenant or assignee, Landlord shall have the option, in its sole discretion, in the event of any proposed subletting or assignment, to terminate this Lease, or in the case of a proposed subletting of less than the entire Premises, to recapture the portion of the Premises to be sublet, as of the dale the subletting or assignment is to be effective. The option shall be exercised, if at all, by Landlord giving Tenant written notice given by Landlord to Tenant within sixty (60) days following Landlord’s receipt of Tenant’s written notice as required above; provided, however, that if Landlord exercises such option, Tenant may void such election by withdrawing its request to sublease or assign within ten (10) days of Landlord’s notice. If this Lease shall be terminated with respect to the entire Premises pursuant to this Section, the Term of this Lease shall end on the date slated in Tenant’s notice as the effective date of the sublease or assignment as if that date had been originally fixed in this Lease for the expiration of the Term. If Landlord recaptures under this Section only a portion of the Premises, the rent to be paid from time to time during the unexpired Term shall abate proportionately based on the proportion by which the approximate square footage of the remaining portion of the Premises shall be less than that of the Premises as of the date immediately prior to such recapture. Tenant shall, at Tenant’s own cost and expense, discharge in full any outstanding commission obligation on the part of Landlord with respect to this Lease, and any commissions which may be due and owing as a result of any proposed assignment or subletting, whether or not the Premises are recaptured pursuant to this Section 9.3 and rented by Landlord to the proposed tenant or any other tenant.

9.4 In the event that Tenant sells, sublets, assigns or transfers this Lease, Tenant shall pay to Landlord as additional rent an amount equal to fifty percent (50%) of any Increased Rent (as defined below) when and as such Increased Rent is received by Tenant. As used in this Section, “Increased Rent” shall mean the excess of (i) all rent and other consideration which Tenant is entitled to receive by reason of any sale, sublease, assignment or other transfer of this Lease, over (ii) the rent otherwise payable by Tenant under this Lease at such time. For purposes of the foregoing, any consideration received by Tenant in form other than cash shall be valued at its fair market value as determined by Landlord in good faith.

9.5 Notwithstanding any other provision hereof, Tenant shall have no right to make (and Landlord shall have the absolute right to refuse consent to) any assignment of this Lease or sublease of any portion of the Premises if at the time of either Tenant’s notice of the proposed assignment or sublease or the proposed commencement date thereof, there shall exist any uncured default of Tenant or matter which will become a default of Tenant with passage of time unless cured, or if the proposed assignee or sublessee is an entity: (a) with which Landlord is already in negotiation as evidenced by the issuance of a written proposal; (b) is already an occupant of the Building unless Landlord is unable to provide the amount of space required by such occupant; (c) is a governmental agency; (d) is incompatible with the character of occupancy of the Building; or (c) would subject the Premises to a use which would: (i) involve increased personnel or wear upon the Building; (ii) violate any exclusive right granted to another tenant of the Building; (iii) require any addition to or modification of the Premises or the Building in order to comply with building code or other governmental requirements; or, (iv) involve a violation of Section 1.2. Tenant expressly agrees that Landlord shall have the absolute right to refuse consent to any such assignment or sublease and that for the purposes of any statutory or other requirement of reasonableness on the part of Landlord such refusal shall be reasonable.

9.6 Upon any request to assign or sublet, Tenant will pay to Landlord the Assignment/Subletting Fee plus, on demand, a sum equal to all of Landlord’s costs, including reasonable attorney’s fees, incurred in investigating and considering any proposed or purported assignment or pledge of this Lease or sublease of any of the Premises, regardless of whether Landlord shall consent to, refuse consent, or determine that Landlord’s consent is not required for, such assignment, pledge or sublease. Any purported sale, assignment, mortgage, transfer of this Lease or subletting which does not comply with the provisions of this Article 9 shall be void.

9.7 If Tenant is a corporation, partnership or trust, any transfer or transfers of or change or changes within any twelve month period in the number of the outstanding voting shares of the corporation, the general partnership interests in the partnership or the identity of the persons or entities controlling the activities of such partnership or trust resulting in the persons or entities owning or controlling a majority of such shares, partnership interests or activities of such partnership or trust at the beginning of such period no longer having such ownership or control shall be regarded as equivalent to an assignment of this Lease to the persons or entities acquiring such ownership or control and shall be subject to all the provisions of this Article 9 to the same extent and for all intents and purposes as though such an assignment.

8

10. INDEMNIFICATION. None of the Landlord Entities shall be liable and Tenant hereby waives all claims against them for any damage to any property or any injury to any person in or about the Premises or the Building by or from any cause whatsoever (including without limiting the foregoing, rain or water leakage of any character from the roof, windows, walls, basement, pipes, plumbing works or appliances, the Building not being in good condition or repair, gas, fire, oil, electricity or theft), except to the extent caused by or arising from the gross negligence or willful misconduct of Landlord or its agents, employees or contractors. Tenant shall protect, indemnify and hold the Landlord Entities harmless from and against any and all loss, claims, liability or costs (including court costs and attorney’s fees) incurred by reason of (a) any damage to any property (including but not limited to property of any Landlord Entity) or any injury (including but not limited to death) to any person occurring in, on or about the Premises or the Building to the extent that such injury or damage shall be caused by or arise from any actual or alleged act, neglect, fault, or omission by or of Tenant, its agents, servants, employees, invitees, or visitors to meet any standards imposed by any duty with respect to the injury or damage; (b) the conduct or management of any work or thing whatsoever done by the Tenant in or about the Premises or from transactions of the Tenant concerning the Premises; (c) Tenant’s failure to comply with any and all governmental laws, ordinances and regulations applicable to the condition or use of the Premises or its occupancy; or (d) any breach or default on the part of Tenant in the performance of any covenant or agreement on the part of the Tenant to be performed pursuant to this Lease. The provisions of this Article shall survive the termination of this Lease with respect to any claims or liability accruing prior to such termination.

11. INSURANCE.

11.1 Tenant shall keep in force throughout the Term: (a) a Commercial General Liability insurance policy or policies to protect the Landlord Entities against any liability to the public or to any invitee of Tenant or a Landlord Entity incidental to the use of or resulting from any accident occurring in or upon the Premises with a limit of not less $1,000,000.00 per occurrence and not less than $2,000,000.00 in the annual aggregate, or such larger amount as Landlord may prudently require from time to time, covering bodily injury and property damage liability and $1,000,000 products/completed operations aggregate; (b) Business Auto Liability covering owned, non-owned and hired vehicles with a limit of not less than $ 1,000,000 per accident; (c) insurance protecting against liability under Worker’s Compensation Laws with limits at least as required by statute; (d) Employers Liability with limits of $500,000 each accident, $500,000 disease policy limit, $500,000 disease—each employee; (e) All Risk or Special Form coverage protecting Tenant against loss of or damage to Tenant’s alterations, additions, improvements, carpeting, floor coverings, panelings, decorations, fixtures, inventory and other business personal property situated in or about the Premises to the full replacement value of the property so insured; and, (f) Business Interruption Insurance with limit of liability representing loss of at least approximately six months of income.

11.2 Each of the aforesaid policies shall (a) be provided at Tenant’s expense; (b) name the Landlord and building management company, if any, as additional insureds; (c) be issued by an insurance company with a minimum Best’s rating of “A:VII” during the Term; and (d) provide that said insurance shall not be canceled unless thirty (30) days prior written notice (ten days for non-payment of premium) shall have been given to Landlord; and said policy or policies or certificates thereof shall be delivered to Landlord by Tenant upon the Commencement Date and at least thirty (30) days prior to each renewal of said insurance.

11.3 Whenever Tenant shall undertake any alterations, additions or improvements in, to or about the Premises (“Work”) the aforesaid insurance protection must extend to and include injuries to persons and damage to property arising in connection with such Work, without limitation including liability under any applicable structural work act, and such other insurance as Landlord shall require; and the policies of or certificates evidencing such insurance must be delivered to Landlord prior to the commencement of any such Work.

12. WAIVER OF SUBROGATION. So long as their respective insurers so permit, Tenant and Landlord hereby mutually waive their respective rights of recovery against each other for any loss insured by fire, extended coverage, All Risks or other insurance now or hereafter existing for the benefit of the respective party but only to the extent of the net insurance proceeds payable under such policies. Each party shall obtain any special endorsements required by their insurer to evidence compliance with the aforementioned waiver.

13. SERVICES AND UTILITIES. Tenant shall pay for all water, gas, heat, light, power, telephone, sewer, sprinkler system charges and other utilities and services used on or from the Premises, together with any taxes, penalties, and surcharges or the like pertaining thereto and any maintenance charges for utilities. Tenant shall furnish all electric light bulbs, tubes and ballasts, battery packs for emergency lighting and fire extinguishers. If any such services are not separately metered to Tenant, Tenant shall pay such proportion of all charges jointly metered with other premises as determined by Landlord, in its sole discretion, to be reasonable. Any such charges paid by Landlord and assessed against Tenant shall be immediately payable to Landlord on demand and shall be additional rent hereunder. Landlord shall in no event be liable for any interruption or failure of utility services on or to the Premises.

9

14. HOLDING OVER. Tenant shall pay Landlord for each day Tenant retains possession of the Premises or part of them after termination of this Lease by lapse of time or otherwise at the rate (“Holdover Rate”) which shall be 150% of the greater of: (a) the amount of the Annual Rent for the last period prior to the date of such termination plus all Rent Adjustments under Article 4; and, (b) the then market rental value of the Premises as determined by Landlord assuming a new lease of the Premises of the then usual duration and other terms, in either case prorated on a daily basis, and also pay all damages sustained by Landlord by reason of such retention. If Landlord gives notice to Tenant of Landlord’s election to that effect, such holding over shall constitute renewal of this Lease for a period from month to month or one year, whichever shall be specified in such notice, in either case at the Holdover Rate, but if the Landlord does not so elect, no such renewal shall result notwithstanding acceptance by Landlord of any sums due hereunder after such termination; and instead, a tenancy at sufferance at the Holdover Rate shall be deemed to have been created. In any event, no provision of this Article 14 shall be deemed to waive Landlord’s right of reentry or any other right under this Lease or at law.

15. SUBORDINATION. Without the necessity of any additional document being executed by Tenant for the purpose of effecting a subordination, this Lease shall be subject and subordinate at all times to ground or underlying leases and to the lien of any mortgages or deeds of trust now or hereafter placed on, against or affecting the Building, Landlord’s interest or estate in the Building, or any ground or underlying lease; provided, however, that if the lessor, mortgagee, trustee, or holder of any such mortgage or deed of trust elects to have Tenant’s interest in this Lease be superior to any such instrument, then, by notice to Tenant, this Lease shall be deemed superior, whether this Lease was executed before or after said instrument. Notwithstanding the foregoing. Tenant covenants and agrees to execute and deliver upon demand such further instruments evidencing such subordination or superiority of this Lease as may be required by Landlord.

16. RULES AND REGULATIONS. Tenant shall faithfully observe and comply with all the rules and regulations as set forth in Exhibit C to this Lease and all reasonable modifications of and additions to them from time to time put into effect by Landlord. Landlord shall not be responsible to Tenant for the non-performance by any other tenant or occupant of the Building of any such rules and regulations.

17. REENTRY BY LANDLORD.

17.1 Landlord reserves and shall at all times have the right to re-enter the Premises to inspect the same, to show said Premises to prospective purchasers, mortgagees or tenants, and to alter, improve or repair the Premises and any portion of the Building, without abatement of rent, and may for that purpose erect, use and maintain scaffolding, pipes, conduits and other necessary structures and open any wall, ceiling or floor in and through the Building and Premises where reasonably required by the character of the work to be performed, provided entrance to the Premises shall not be blocked thereby, and further provided that the business of Tenant shall not be interfered with unreasonably.

17.2 Landlord shall have the right at any time to change the name, number or designation by which the Building is commonly known. In the event that Landlord damages any portion of any wall or wall covering, ceiling, or floor or floor covering within the Premises, Landlord shall repair or replace the damaged portion to match the original as nearly as commercially reasonable but shall not be required to repair or replace more than the portion actually damaged.

17.3 Tenant hereby waives any claim for damages for any injury or inconvenience to or interference with Tenant’s business, any loss of occupancy or quiet enjoyment of the Premises, and any other loss occasioned by any action of Landlord authorized by this Article 17.

17.4 For each of the aforesaid purposes, Landlord shall at all times have and retain a key with which to unlock all of the doors in the Premises, excluding Tenant’s vaults and safes or special security areas (designated in advance), and Landlord shall have the right to use any and all means which Landlord may deem proper to open said doors in an emergency to obtain entry to any portion of the Premises. As to any portion to which access cannot be had by means of a key or keys in Landlord’s possession, Landlord is authorized to gain access by such means as Landlord shall elect and the cost of repairing any damage occurring in doing so shall be borne by Tenant and paid to Landlord as additional rent upon demand.

18. DEFAULT.

18.1 Except as otherwise provided in Article 20, the following events shall be deemed to be Events of Default under this Lease:

18.1.1 Tenant shall fail to pay when due any sum of money becoming due to be paid to Landlord under this Lease, whether such sum be any installment of the rent reserved by this Lease, any other amount treated as additional rent under this Lease, or any other payment or reimbursement to Landlord required by this Lease, whether or not treated as additional rent under this Lease, and such failure shall continue for a period of. five days after written notice that such payment was not made when due, but if any such notice shall be given, for the twelve month period commencing with the date of such notice, the failure to pay within five days after due any additional sum of money becoming due to be paid to Landlord under this Lease during such period shall be an Event of Default, without notice.

10

18.1.2 Tenant shall fail to comply with any term, provision or covenant of this Lease which is not provided for in another Section of this Article and shall not cure such failure within twenty (20) days (forthwith, if the failure involves a hazardous condition) after written notice of such failure to Tenant.

18.1.3 Tenant shall fail to vacate the Premises immediately upon termination of this Lease, by lapse of time or otherwise, or upon termination of Tenant’s right to possession only.

18.1.4 Tenant shall become insolvent, admit in writing its inability to pay its debts generally as they become due, file a petition in bankruptcy or a petition to take advantage of any insolvency statute, make an assignment for the benefit of creditors, make a transfer in fraud of creditors, apply for or consent to the appointment of a receiver of itself or of the whole or any substantial part of its property, or file a petition or answer seeking reorganization or arrangement under the federal bankruptcy laws, as now in effect or hereafter amended, or any other applicable law or statute of the United States or any state thereof.

| 18.1.5 | A court of competent jurisdiction shall enter an order, judgment or decree adjudicating Tenant bankrupt, or appointing a receiver of Tenant, or of the whole or any substantial part of its property, without the consent of Tenant, or approving a petition filed against Tenant seeking reorganization or arrangement of Tenant under the bankruptcy laws of the United States, as now in effect or hereafter amended, or any state thereof, and such order, judgment or decree shall not be vacated or set aside or stayed within thirty (30) days from the date of entry thereof. |

| 19. | REMEDIES. |

19.1 Except as otherwise provided in Article 20, upon the occurrence of any of the Events of Default described or referred to in Article 18, Landlord shall have the option to pursue any one or more of the following remedies without any notice or demand whatsoever, concurrently or consecutively and not alternatively:

19.1.1 Landlord may, at its election, terminate this Lease or terminate Tenant’s right to possession only, without terminating the Lease.

19.1.2 Upon any termination of this Lease, whether by lapse of time or otherwise, or upon any termination of Tenant’s right to possession without termination of the Lease, Tenant shall surrender possession and vacate the Premises immediately, and deliver possession thereof to Landlord, and Tenant hereby grants to Landlord full and free license to enter into and upon the Premises in such event and to repossess Landlord of the Premises as of Landlord’s former estate and to expel or remove Tenant and any others who may be occupying or be within the Premises and to remove Tenant’s signs and other evidence of tenancy and all other property of Tenant therefrom without being deemed in any manner guilty of trespass, eviction or forcible entry or detainer, and without incurring any liability for any damage resulting therefrom, Tenant waiving any right to claim damages for such re-entry and expulsion, and without relinquishing Landlord’s right to rent or any other right given to Landlord under this Lease or by operation of law.

19.1.3 Upon any termination of this Lease, whether by lapse of time or otherwise, Landlord shall be entitled to recover as damages, all rent, including any amounts treated as additional rent under this Lease, and other sums due and payable by Tenant on the date of termination, plus as liquidated damages and not as a penalty, an amount equal to the sum of: (a) an amount equal to the then present value of the rent reserved in this Lease for the residue of the stated Term of this Lease including any amounts treated as additional rent under this Lease and all other sums provided in this Lease to be paid by Tenant, minus the fair rental value of the Premises for such residue; (b) the value of the time and expense necessary to obtain a replacement tenant or tenants, and the estimated expenses described in Section 19.1.4 relating to recovery of the Premises, preparation for reletting and for reletting itself; and (c) the cost of performing any other covenants which would have otherwise been performed by Tenant.

19.1.4 Upon any termination of Tenant’s right to possession only without termination of the Lease:

19.1.4.1 Neither such termination of Tenant’s right to possession nor Landlord’s taking and holding possession thereof as provided in Section 19.1.2 shall terminate the Lease or release Tenant, in whole or in part, from any obligation, including Tenant’s obligation to pay the rent, including any amounts treated as additional rent, under this Lease for the full Term, and if Landlord so elects Tenant shall pay forthwith to Landlord the sum equal to the entire amount of the rent, including any amounts treated as additional rent under this Lease, for the remainder of the Term plus any other sums provided in this Lease to be paid by Tenant for the remainder of the Term.

11

19.1.4.2 Landlord shall use commercially reasonable efforts to relet the Premises but Landlord and Tenant agree that nevertheless Landlord shall not be required to give any preference or priority to the showing or leasing of the Premises over any other space that Landlord may be leasing or have available and may place a suitable prospective tenant in any such other space regardless of when such other space becomes available. In connection with or in preparation for any reletting, Landlord may, but shall not be required to, make repairs, alterations and additions in or to the Premises and redecorate the same to the extent Landlord deems necessary or desirable, and Tenant shall, upon demand, pay the cost thereof, together with Landlord’s expenses of reletting, including, without limitation, any commission incurred by Landlord. Landlord shall not be required to observe any instruction given by Tenant about any reletting or accept any tenant offered by Tenant unless such offered tenant has a creditworthiness acceptable to Landlord and leases the entire Premises upon terms and conditions including a rate of rent (after giving effect to all expenditures by Landlord for tenant improvements, broker’s commissions and other leasing costs) all no less favorable to Landlord than as called for in this Lease, nor shall Landlord be required to make or permit any assignment or sublease for more than the current term or which Landlord would not be required to permit under the provisions of Article 9.

19.1.4.3 Until such time as Landlord shall elect to terminate the Lease and shall thereupon be entitled to recover the amounts specified in such case in Section 19.1.3, Tenant shall pay to Landlord upon demand the full amount of all rent, including any amounts treated as additional rent under this Lease and other sums reserved in this Lease for the remaining Term, together with the costs of repairs, alterations, additions, redecorating and Landlord’s expenses of reletting and the collection of the rent accruing therefrom (including attorney’s fees and broker’s commissions), as the same shall then be due or become due from time to time, less only such consideration as Landlord may have received from any reletting of the Premises; and Tenant agrees that Landlord may file suits from time to time to recover any sums falling due under this Article 19 as they become due. Any proceeds of reletting by Landlord in excess of the amount then owed by Tenant to Landlord from time to time shall be credited against Tenant’s future obligations under this Lease but shall not otherwise be refunded to Tenant or inure to Tenant’s benefit.

19.2 Landlord may, at Landlord’s option, enter into and upon the Premises if Landlord determines in its sole discretion that Tenant is not acting within a commercially reasonable time to maintain, repair or replace anything for which Tenant is responsible under this Lease and correct the same, without being deemed in any manner guilty of trespass, eviction or forcible entry and detainer and without incurring any liability for any damage or interruption of Tenant’s business resulting therefrom. If Tenant shall have vacated the Premises, Landlord may at Landlord’s option re-enter the Premises at any time during the last six months of the then current Term of this Lease and make any and all such changes, alterations, revisions, additions and tenant and other improvements in or about the Premises as Landlord shall elect, all without any abatement of any of the rent otherwise to be paid by Tenant under this Lease.

19.3 If, on account of any breach or default by a party in its obligations under the terms and conditions of this Lease, it shall become necessary or appropriate for the other party to employ or consult with an attorney concerning or to enforce or defend any of its rights or remedies arising under this Lease, the defaulting party agrees to pay all the non-defaulting party’s attorney’s fees so incurred. Tenant expressly waives any right to: (a) trial by jury; and (b) service of any notice required by any present or future law or ordinance applicable to landlords or tenants but not required by the terms of this Lease.

19.4 Pursuit of any of the foregoing remedies shall not preclude pursuit of any of the other remedies provided in this Lease or any other remedies provided by law (all such remedies being cumulative), nor shall pursuit of any remedy provided in this Lease constitute a forfeiture or waiver of any rent due to Landlord under this Lease or of any damages accruing to Landlord by reason of the violation of any of the terms, provisions and covenants contained in this Lease.

19.5 No act or thing done by Landlord or its agents during the Term shall be deemed a termination of this Lease or an acceptance of the surrender of the Premises, and no agreement to terminate this Lease or accept a surrender of said Premises shall be valid, unless in writing signed by Landlord. No waiver by Landlord of any violation or breach of any of the terms, provisions and covenants contained in this Lease shall be deemed or construed to constitute a waiver of any other violation or breach of any of the terms, provisions and covenants contained in this Lease. Landlord’s acceptance of the payment of rental or other payments after the occurrence of an Event of Default shall not be construed as a waiver of such Default, unless Landlord so notifies Tenant in writing. Forbearance by Landlord in enforcing one or more of the remedies provided in this Lease upon an Event of Default shall not be deemed or construed to constitute a waiver of such Default or of Landlord’s right to enforce any such remedies with respect to such Default or any subsequent Default.

19.6 To secure the payment of all rentals and other sums of money becoming due from Tenant under this Lease, Landlord shall have and Tenant grants to Landlord a first lien upon the leasehold interest of Tenant under this Lease, which lien may be enforced in equity, and a continuing security interest upon all goods, wares, equipment, fixtures, furniture, inventory, accounts, contract rights, chattel paper and other personal property of Tenant situated on the Premises, and such property shall not be removed therefrom without the consent of Landlord until all arrearages in rent as well as any and all other sums of money then due to Landlord under this Lease shall

12

first have been paid and discharged. Landlord agrees to subordinate its interest hereunder to Tenant’s primary institutional lender, other than for the Receivables Pledge. In the event of a Default under this Lease, Landlord shall have, in addition to any other remedies provided in this Lease or by law, all rights and remedies under the Uniform Commercial Code, including without limitation the right to sell the property described in this Section 19.6 at public or private sale upon five (5) days’ notice to Tenant. Tenant shall execute all such financing statements and other instruments as shall be deemed necessary or desirable in Landlord’s discretion to perfect the security interest hereby created.

19.7 Any and all property which may be removed from the Premises by Landlord pursuant to the authority of this Lease or of law, to which Tenant is or may be entitled, may be handled, removed and/or stored, as the case may be, by or at the direction of Landlord but at the risk, cost and expense of Tenant, and Landlord shall in no event be responsible for the value, preservation or safekeeping thereof. Tenant shall pay to Landlord, upon demand, any and all expenses incurred in such removal and all storage charges against such property so long as the same shall be in Landlord’s possession or under Landlord’s control. Any such property of Tenant not retaken by Tenant from storage within thirty (30) days after removal from the Premises shall, at Landlord’s option, be deemed conveyed by Tenant to Landlord under this Lease as by a bill of sale without further payment or credit by Landlord to Tenant.

| 20. | TENANT’S BANKRUPTCY OR INSOLVENCY. |

20.1 If at any time and for so long as Tenant shall be subjected to the provisions of the United States Bankruptcy Code or other law of the United States or any state thereof for the protection of debtors as in effect at such time (each a “Debtor’s Law”):

20.1.1 Tenant, Tenant as debtor-in-possession, and any trustee or receiver of Tenant’s assets (each a “Tenant’s Representative”) shall have no greater right to assume or assign this Lease or any interest in this Lease, or to sublease any of the Premises than accorded to Tenant in Article 9, except to the extent Landlord shall be required to permit such assumption, assignment or sublease by the provisions of such Debtor’s Law. Without limitation of the generality of the foregoing, any right of any Tenant’s Representative to assume or assign this Lease or to sublease any of the Premises shall be subject to the conditions that:

20.1.1.1 Such Debtor’s Law shall provide to Tenant’s Representative a right of assumption of this Lease which Tenant’s Representative shall have timely exercised and Tenant’s Representative shall have fully cured any default of Tenant under this Lease.

20.1.1.2 Tenant’s Representative or the proposed assignee, as the case shall be, shall have deposited with Landlord as security for the timely payment of rent an amount equal to the larger of: (a) three months’ rent and other monetary charges accruing under this Lease; and (b) any sum specified in Article 5; and shall have provided Landlord with adequate other assurance of the future performance of the obligations of the Tenant under this Lease. Without limitation, such assurances shall include, at least, in the case of assumption of this Lease, demonstration to the satisfaction of the Landlord that Tenant’s Representative has and with continue to have sufficient unencumbered assets after the payment of all secured obligations and administrative expenses to assure Landlord that Tenant’s Representative will have sufficient funds to fulfill the obligations of Tenant under this Lease; and, in the case of assignment, submission of current financial statements of the proposed assignee, audited by an independent certified public accountant reasonably acceptable to Landlord and showing a net worth and working capital in amounts determined by Landlord to be sufficient to assure the future performance by such assignee of all of the Tenant’s obligations under this Lease.

20.1.1.3 The assumption or any contemplated assignment of this Lease or subleasing any part of the Premises, as shall be the case, will not breach any provision in any other lease, mortgage, financing agreement or other agreement by which Landlord is bound.

20.1.1.4 Landlord shall have, or would have had absent the Debtor’s Law, no right under Article 9 to refuse consent to the proposed assignment or sublease by reason of the identity or nature of the proposed assignee or sublessee or the proposed use of the Premises concerned.

21. QUIET ENJOYMENT. Landlord represents and warrants that it has full right and authority to enter into this Lease and that Tenant, while paying the rental and performing its other covenants and agreements contained in this Lease, shall peaceably and quietly have, hold and enjoy the Premises for the Term without hindrance or molestation from Landlord subject to the terms and provisions of this Lease. Landlord shall not be liable for any interference or disturbance by other tenants or third persons, nor shall Tenant be released from any of the obligations of this Lease because of such interference or disturbance.

22. DAMAGE BY FIRE, ETC.

22.1 In the event the Premises or the Building are damaged by fire or other cause and in Landlord’s reasonable estimation such damage can be materially restored within one hundred fifty (150) days, Landlord shall

13

forthwith repair the same and this Lease shall remain in full force and effect, except that Tenant shall be entitled to a proportionate abatement in rent from the date of such damage. Such abatement of rent shall be made pro rata in accordance with the extent to which the damage and the making of such repairs shall interfere with the use and occupancy by Tenant of the Premises from time to time. Within twenty (20) days from the date of such damage, Landlord shall notify Tenant, in writing, of Landlord’s reasonable estimation of the length of time within which material restoration can be made, and Landlord’s determination shall be binding on Tenant. For purposes of this Lease, the Building or Premises shall be deemed “materially restored” if they are in such condition as would not prevent or materially interfere with Tenant’s use of the Premises for the purpose for which it was being used immediately before such damage.

22.2 If such repairs cannot, in Landlord’s reasonable estimation, be made within one hundred fifty (150) days, Landlord and Tenant shall each have the option of giving the other, at any time within sixty (60) days after such damage, notice terminating this Lease as of the date of such damage. In the event of the giving of such notice, this Lease shall expire and all interest of the Tenant in the Premises shall terminate as of the date of such damage as if such date had been originally fixed in this Lease for the expiration of the Term. In the event that neither Landlord nor Tenant exercises its option to terminate this Lease, then Landlord shall repair or restore such damage, this Lease continuing in full force and effect, and the rent hereunder shall be proportionately abated as provided in Section 22.1.

22.3 Landlord shall not be required to repair or replace any damage or loss by or from fire or other cause to any panelings, decorations, partitions, additions, railings, ceilings, floor coverings, office fixtures or any other property or improvements installed on the Premises or belonging to Tenant. Any insurance which may be carried by Landlord or Tenant against loss or damage to the Building or Premises shall be for the sole benefit of the party carrying such insurance and under its sole control.

22.4 In the event that Landlord should fail to complete such repairs and material restoration within thirty (30) days after the date estimated by Landlord therefor as extended by this Section 22.4, Tenant may at its option and as its sole remedy terminate this Lease by delivering written notice to Landlord, within fifteen (15) days after the expiration of said period of time, whereupon the Lease shall end on the date of such notice or such later date fixed in such notice as if the date of such notice was the date originally fixed in this Lease for the expiration of the Term; provided, however, that if construction is delayed because of changes, deletions or additions in construction requested by Tenant, strikes, lockouts, casualties, Acts of God, war, material or labor shortages, government regulation or control or other causes beyond the reasonable control of Landlord, the period for restoration, repair or rebuilding shall be extended for the amount of time Landlord is so delayed.

22.5 Notwithstanding anything to the contrary contained in this Article: (a) Landlord shall not have any obligation whatsoever to repair, reconstruct, or restore the Premises when the damages resulting from any casualty covered by the provisions of this Article 22 occur during the last twelve (12) months of the Term or any extension thereof, but if Landlord determines not to repair such damages Landlord shall notify Tenant and if such damages shall render any material portion of the Premises untenantable Tenant shall have the right to terminate this Lease by notice to Landlord within fifteen (15) days after receipt of Landlord’s notice; and (b) in the event the holder of any indebtedness secured by a mortgage or deed of trust covering the Premises or Building requires that any insurance proceeds be applied to such indebtedness, then Landlord shall have the right to terminate this Lease by delivering written notice of termination to Tenant within fifteen (15) days after such requirement is made by any such holder, whereupon this Lease shall end on the date of such damage as if the date of such damage were the date originally fixed in this Lease for the expiration of the Term.

22.6 In the event of any damage or destruction to the Building or Premises by any peril covered by the provisions of this Article 22, it shall be Tenant’s responsibility to properly secure the Premises and upon notice from Landlord to remove forthwith, at its sole cost and expense, such portion of all of the property belonging to Tenant or its licensees from such portion or all of the Building or Premises as Landlord shall request.

23. EMINENT DOMAIN. If all or any substantial part of the Premises shall be taken or appropriated by any public or quasi-public authority under the power of eminent domain, or conveyance in lieu of such appropriation, either party to this Lease shall have the right, at its option, of giving the other, at any time within thirty (30) days after such taking, notice terminating this Lease, except that Tenant may only terminate this Lease by reason of taking or appropriation, if such taking or appropriation shall be so substantial as to materially interfere with Tenant’s use and occupancy of the Premises. If neither party to this Lease shall so elect to terminate this Lease, the rental thereafter to be paid shall be adjusted on a fair and equitable basis under the circumstances. In addition to the rights of Landlord above, if any substantial part of the Building shall be taken or appropriated by any public or quasi-public authority under the power of eminent domain or conveyance in lieu thereof, and regardless of whether the Premises or any part thereof are so taken or appropriated, Landlord shall have the right, at its sole option, to terminate this Lease. Landlord shall be entitled to any and all income, rent, award, or any interest whatsoever in or upon any such sum, which may be paid or made in connection with any such public or quasi-public use or purpose, and Tenant hereby assigns to Landlord any interest it may have in or claim to all or any part of such sums, other than any separate award which may be made with respect to Tenant’s trade fixtures and moving expenses; Tenant shall make no claim against Landlord for the value of any unexpired Term.

14

24. SALE BY LANDLORD. In event of a sale or conveyance by Landlord of the Building, the same shall operate to release Landlord from any future liability upon any of the covenants or conditions, expressed or implied, contained in this Lease in favor of Tenant, and in such event Tenant agrees to look solely to the responsibility of the successor in interest of Landlord in and to this Lease. Except as set forth in this Article 24, this Lease shall not be affected by any such sale and Tenant agrees to attorn to the purchaser or assignee. If any security has been given by Tenant to secure the faithful performance of any of the covenants of this Lease, Landlord may transfer or deliver said security, as such, to Landlord’s successor in interest and thereupon Landlord shall be discharged from any further liability with regard to said security.

25. ESTOPPEL CERTIFICATES. Within ten (10) days following any written request which Landlord may make from time to time, Tenant shall execute and deliver to Landlord or mortgagee or prospective mortgagee a sworn statement certifying: (a) the date of commencement of this Lease; (b) the fact that this Lease is unmodified and in full force and effect (or, if there have been modifications to this Lease, that this lease is in full force and effect, as modified, and stating the date and nature of such modifications); (c) the date to which the rent and other sums payable under this Lease have been paid; (d) the fact that there are no current defaults under this Lease by either Landlord or Tenant except as specified in Tenant’s statement; and (e) such other matters as may be requested by Landlord. Landlord and Tenant intend that any statement delivered pursuant to this Article 25 may be relied upon by any mortgagee, beneficiary or purchaser and Tenant shall be liable for all loss, cost or expense resulting from the failure of any sale or funding of any loan caused by any material misstatement contained in such estoppel certificate. Tenant irrevocably agrees that if Tenant fails to execute and deliver such certificate within such ten (10) day period Landlord or Landlord’s beneficiary or agent may execute and deliver such certificate on Tenant’s behalf, and that such certificate shall be fully binding on Tenant.

26. SURRENDER OF PREMISES.

26.1 Tenant shall, at least ten (10) days before the last day of the Term, arrange to meet Landlord for a joint inspection of the Premises. In the event of Tenant’s failure to arrange such joint inspection to be held prior to vacating the Premises, Landlord’s inspection at or after Tenant’s vacating the Premises shall be conclusively deemed correct for purposes of determining Tenant’s responsibility for repairs and restoration.