Exhibit 10.33

LEASE RENEWAL AGREEMENT

| Effective Date: | January 1, 2010 | |

| Leased Premises: | 2190 Dividend Drive, Columbus, Ohio | |

| Landlord: | Dividend Drive LLC | |

| Tenant: | Intellenetics, Inc. | |

Landlord and Tenant are parties to a Lease dated June 21, 1999, originally made by SFERS Real Estate Corp. T, Landlord and The Avatar Group, Inc., Tenant, under which Tenant leased 12,302 square feet located at 1290 Dividend Drive, Columbus, Ohio 43228 from Landlord. The Lease as been amended by a First, Second, Third and Fourth Amendment, and by a License to Use Space for Satellite Dish.

The Lease, as amended, terminates on January 31, 2010.

The parties desire to renew said Lease for an additional three (3) year term, reducing the Premises Rentable Area in Suite 2190 from the present 12,302 square feet to 6,000 square feet, all upon the terms hereinafter set forth.

Accordingly, Landlord and Tenant hereby agree to renew and further amend the Lease dated June 21, 1999 (the “Lease”), which is attached hereto and made a part hereof as Exhibit “A’, as follows:

| 1. | Leased Premises: |

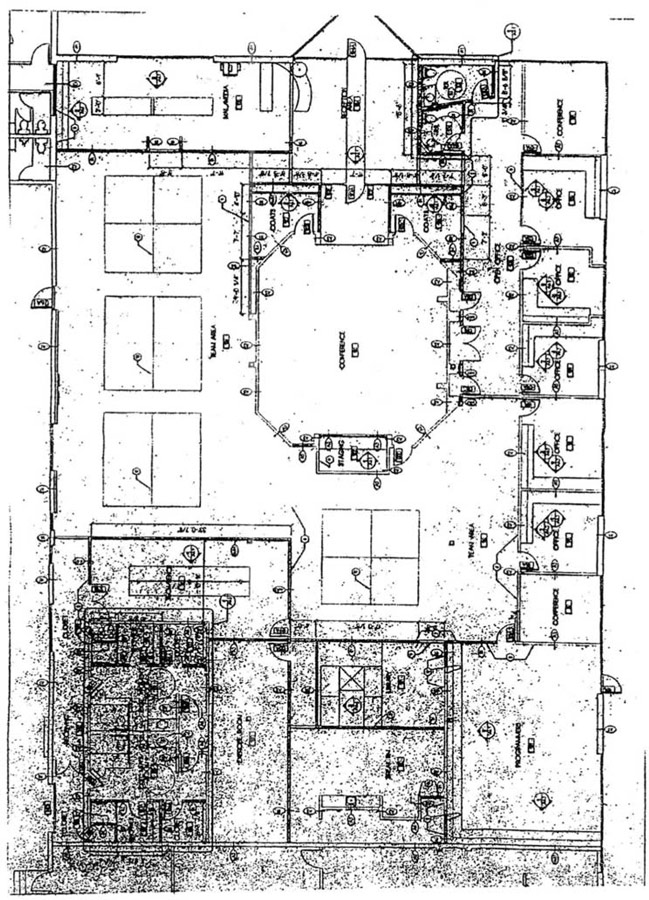

The Premises Rentable Area during the Renewal Term shall be reduced from 12,302 square feet to 6,000 square feet, as shown on Exhibit B. Nevertheless, Landlord will not build a demising wall to separate the 6,000 square feet of Rentable Area from the balance of the area until Landlord procures a tenant to lease part or all of the residual 6,302 square feet (approximate).

When the Landlord finds a tenant for the 6,302 square feet of residual space Lessor will construct, at its cost, a demising wall to divide and separate the Tenant’s 6,000 square feet of Rentable Area from the remaining 6,302 square feet. Landlord will also re-balance the HVAC systems and lighting. At that time, Intellentics’ obligation to pay for water and sewer usage shall be reduced proportionately for the remainder of the Lease Renewal Term.

Accordingly, Tenant shall not be required to relocate its operations into the 6,000 square foot Rentable Area shown on Exhibit “B” until the Landlord finds a Tenant for part or all of the residual 6,302 square feet. Tenant agrees that when Landlord finds a Tenant for

part or all of the 6,302 square feet of residual space, Tenant will relocate into the approximately 6,000 square feet of Rentable Area. In addition, the exact square footage of the Rentable Area shall be determined by measurement after construction of the demising wall, and Rent and Rent Adjustments for Common Area Expenses and Taxes shall be adjusted accordingly for the balance of the Lease Renewal Term.

| 2. | Lease Renewal Term: |

The Lease Renewal Term shall be thirty-six (36) months, commencing on January 1, 2010 and terminating on December 31, 2013.

| 3. | Rent: |

Tenant shall pay Landlord a total of $121,500.00 (One Hundred Twenty-One Thousand Five Hundred and 00/100 Dollars) in thirty-six (36) equal monthly installments of $3,375.00 (Three Thousand, Three Hundred Seventy-Five and 00/100 Dollars) based upon 6,000 square feet of Rentable Area.

When Landlord finds a tenant for the 6,302 square feet of residual space and the square footage occupied by Intellenetics, Inc. is adjusted up or down as stated in Section 1, above from the 6,000 square feet of Rentable Area described herein, then Rent and Rent Adjustment for Common Area Expenses and Taxes shall be adjusted based upon the actual Rentable Area used by Intellenetics, Inc. as determined by such measurement.

| 4. | Rent Adjustments for Expenses and Taxes: |

Until the measurement is made as stated in Section 1 above, the Tenant’s proportionate share of said expenses and taxes as defined in the Lease shall be reduced to 13.6% (6,000 SF / 43,976 SF) during the Lease Renewal Term, calculated in accordance with Section 4 of the Lease.

Estimated Expenses and Taxes for Calendar year 2010 are $1,625.00 per month or $3.25 per square foot.

| 5. | Tenant Direct Expenses within the Leased Premises: |

| A. | 50% of gas and electric utility usage within the original 12,302 square feet. |

| B. | 100% of water/sewer usage within the original 12,302 square feet until Landlord procures a tenant for the approximately 6,302 square feet of residual space. Upon such occupancy, Tenant’s share of water/sewer costs shall be reduced to 49% (6,000/12,302) for the remainder of the Lease Renewal Term. |

| C. | Janitorial services and supplies within the leased premises. |

| D. | Light bulb replacement within the leased premises. |

| E. | Pest control within the leased premises. |

| F. | Lessee’s Contents and Liability Insurance. |

| 6. | Landlord Expenses Not Subject to Reimbursement by Tenant Under Section 4 of the Lease: |

| A. | 50% of gas and electric utility usage within the original 12,302 square feet. |

| B. | Capital replacements related to building structure, roof, HVAC system and parking lot. |

| C. | Leasing commissions. |

| D. | Legal expenses related to lease negotiations |

| 7. | Leasehold Improvement Allowance from Lessor: None. Tenant agrees to continue occupancy of the Premises Rentable Area in “As Is” condition. |

ALL OTHER TERMS AND CONDITIONS OF THE LEASE, AS AMENDED, SHALL REMAIN UNCHANGED AND SHALL BE BINDING ON THE LANDLORD AND TENANT AS STATED THEREIN.

Acknowledged and Agreed:

| LANDLORD: Dividend Drive LLC | TENANT: Intellenetics, Inc. | |||||||

| By: | /s/ [ILLEGIBLE] | By: | /s/ A. Michael Chretien | |||||

| Its: | Manager | Its: | Vice President | |||||

STATE OF OHIO :

COUNTY OF FRANKLIN : ss.

The foregoing instrument was acknowledged before me this, 2nd day of September 2009 by [ILLEGIBLE] , Manager of Dividend Drive, LLC, an Ohio limited liability company, on behalf of the Company.

| /s/ PAMELA L. SMITH |

| PAMELA L. SMITH |

| NOTARY PUBLIC, STATE OF OHIO |

| MY COMMISSION EXPIRES JANUARY 1, 2010 |

STATE OF OHIO :

COUNTY OF FRANKLIN : ss.

The foregoing instrument was acknowledged before me this 1st day of September, 2009 by A. Michael Chretien, President of Intellencties, Inc. an Ohio corporation, on behalf of the Corporation.

| /s/ PAMELA L. SMITH |

| PAMELA L. SMITH |

| NOTARY PUBLIC, STATE OF OHIO |

| MY COMMISSION EXPIRES JANUARY 1, 2010 |

Intellenetics

EXHIBIT “B”

|

AGENCY DISCLOSURE STATEMENT |

| ||

The real estate agent who is providing you with this form is required to do so by Ohio law. You will not be bound to pay the agent or the agent’s brokerage by merely signing this form. Instead, the purpose of this form is to confirm that you have been advised of the role of the agent(s) in the transaction proposed below. (For purposes of this form, the term “seller” includes a landlord and the term “buyer” includes a tenant.)

Property Address: 2190 Dividend Drive—Columbus, Ohio 43228

Buyer(s) Tenant: Intellinetics

Seller(s): DIVIDEND DRIVE LLC.

I. TRANSACTION INVOLVING TWO AGENTS IN TWO DIFFERENT BROKERAGES

The buyer (Tenant) will be represented by Chris Nickles and Carol Evans, and CB Richard Ellis.

| [ILLEGIBLE] | AGENTS(S) | BROKERAGE | ||||

| The seller will be represented by | [ILLEGIBLE], | and [ILLEGIBLE] | ||||

| AGENTS(S) | BROKERAGE |

II. TRANSACTION INVOLVING TWO AGENTS IN THE SAME BROKERAGE

If two agents in the real estate brokerage

represent both the buyer and the seller, check the following relationship that will apply:

| ¨ | Agent(s) work(s) for the buyer and |

| Agent(s) work(s) for the seller. Unless personally involved in the transaction, the broker and managers will be “dual agents”, which is further explained on the back of this form. As dual agents they will maintain a neutral position in the transaction and they will protect all parties’ confidential information. |

| ¨ | Every agent in the brokerage represents every “client” of the brokerage. Therefore, agents and will be working for both the buyer and seller as “dual agents”. Dual agency is explained on the back of this form. As dual agents they will maintain a neutral position in the transaction and they will protect all parties’ confidential information. Unless indicated below, neither the agent(s) nor the brokerage acting as a dual agent in this transaction has a personal, family or business relationship with either the buyer or seller. If such a relationship does exist, explain: |

III. TRANSACTION INVOLVING ONLY ONE REAL ESTATE AGENT

Agent(s) and real brokerage will

| ¨ | be “dual agent” representing both parties in this transaction in a neutral capacity. Dual agency is further explained on the back of this form. As dual agents they will maintain a neutral position in the transaction and they will protect all parties’ confidential information Unless indicated below, neither the agent(s) nor the brokerage acting as a dual agent in this transaction has a personal, family or business relationship with either the buyer or seller. If such a relationship does exist, explain: |

| ¨ | represent only the (check one) ¨ seller or ¨ buyer in this transaction as a client. The other party is not represented and agrees to represent his/her own best interest. Any information provided the agent may be disclosed to the agent’s client. |

CONSENT

I (we) consent to the above relationships as we enter into this real estate transaction. If there is a dual agency in this transaction, I(we) acknowledge reading the information regarding dual agency explained on the back of this form.

| /s/ A. Michael Chretien, VP Intellinetics 8/17/09 | /s/ [ILLEGIBLE] | |||||

| XX | BUYER/TENANT DATE | [ILLEGIBLE] DATE | ||||

| : | ||||||

| BUYER/TENANT DATE | [ILLEGIBLE] DATE | |||||

| Page 1 of 2 | Effective 01/01/05 |